Non Operating Income in Continuing Operations Income

What is Non-Operating Income?

Non-operating income is the income earned by a business organization from the activities other than its principal revenue-generating activity examples include profits/loss from the sale of a capital asset or foreign exchange transactions, income from dividends, profits, or other income generated from the investments of the business, etc.

In simple words, a non-operating income of an entity is the income stream on the entity's income statement driven by activities that do not fall under the core business operations of the entity. This type of non-core income stream may take many forms like gains or losses due to fluctuation in foreign exchange, asset impairments or write-downs, income from dividends arising out of investment in associates Investment in Associate are investments in an entity in which the investor has significant influence but not complete authority, like a parent and a subsidiary relationship. The investor has a significant influence when it has 20% to 50% of shares of another entity. read more , capital gains and losses from investments, etc. It is also known by the name peripheral or incidental income.

Table of contents

- What is Non-Operating Income?

- List of Non-Operating Income

- Non-Operating Income Formula

- Non-Operating Income Examples

- Example #1

- Example #2

- Advantages

- Disadvantages

- Limitations

- Points to Remember

- Conclusion

- Recommended Articles

List of Non-Operating Income

- Losses due to impairment or write down of assets When the carrying value (purchase price – accumulated depreciation) of an asset exceeds its fair value, it is referred to as a write down. read more

- Dividend income arising due to investment into associates

- Gains and losses due to investment in financial securities

- Gains and losses due to transactions in foreign currency and hence are affected by fluctuations in foreign exchange rates

- Any gains or losses which may be a one-time non-recurring event Non-recurring items are income statement entries that are unusual and unexpected during regular business operations; examples include profits or losses from sale of asset, impairment costs, restructuring costs, and losses in lawsuits, and inventory write-off. read more

- Any gains or losses which are recurring but non-operating

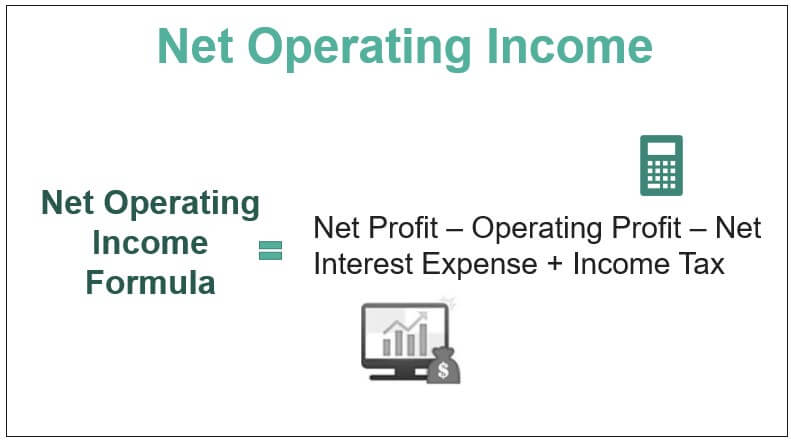

Non-Operating Income Formula

It is usually shown as a "Net Non-Operating Income or Expense" at the bottom of the income statement. Most of the time, it appears after the "Operating Profit" line item.

It can be calculated, as shown below:

Net Non-Operating Income

= Dividend Income

– Losses due to asset impairment

+/- Gains and Losses realized after selling the investment in financial securities

+/- Gains and Losses due to transactions in foreign currency

+/- Gains and Losses due to non-recurring one-time events

+/- Gains and Losses due to recurring but non-operating events

It may not have some fixed formula as it is more dependent upon the classification of the line item as operating or non-operating activity.

The calculation can also be done by –

Net Operating Income = Net Profit – Operating Profit – Net Interest Expense + Income Tax.

You are free to use this image on your website, templates, etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Non Operating Income (wallstreetmojo.com)

This is a back-calculation to decipher the value of non-operating income and expenses from the entity's income statement. Some companies report such income and expenses under a different head.

Non-Operating Income Examples

Let's look at some examples to understand this better.

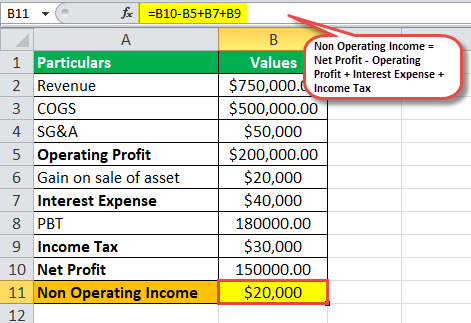

Example #1

Let's assume a fictitious company ABC with an income statement as shown below:

Now in order to calculate the non-operating income from the above income statement, we can follow the back-calculation approach as follows:

Net-Operating Income = $150,000 – $200,000 + $40,000 + $30,000

= $20,000

Now, if we look closely at the income statement The income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over time based on user requirements. read more shown above, it is quite obvious to point at the non-operating line item, i.e., Gain on sale of the asset. But to come to this line item's value based on some formula, we used a back-calculation formula, which gives the same value as for the Gain on the sale of assets.

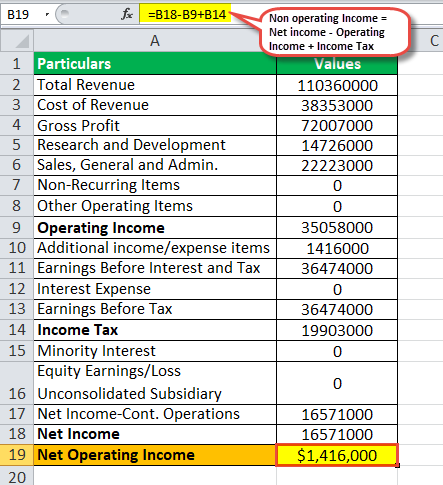

Example #2

Now let's look at a real-life income statement of Microsoft.

= $16,571,000 – $35,058,000+ $19,903,000

=$1,416,000

Advantages

- Non-operating income estimates the proportion of income due to non-operating activities. It allows bifurcating the peripheral income and expenses from the mainstream income from the company's core operations. It allows the stakeholders to compare the pure operating performance of the company and draw a comparison across the peers.

- From the entity's point of view, reporting such income and expenses shows that the entity has nothing to hide. It establishes a transparent image of the entity, and all the stakeholders, including employees and investors, feel more comfortable taking the risk along with the entity's growth plans.

- Reporting the non-operating expenses Non operating expenses are those payments which have no relation with the principal business activities. These are the non-recurring items that appear in the company's income statement, along with the regular business expenses. read more also represent the non-core activities that can be cut down in dire need. Such line items show value in the entity's income statement.

- It also helps the stakeholder assess more realistic figures instead of forgetting them and making plans based on fictitious numbers.

Disadvantages

- It does not reflect the entity's operating performance as it comprises non-core business transactions A business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.). The goods involved have monetary and tangible economic value, which may be recorded and presented in the company's financial statements. read more . It may represent a false impression due to one-time events. Some companies may use it to inflate or deflate the profit to pay fewer taxes or lure investors into raising money from the market.

- Companies may disguise such transactions under other heads to manipulate the bottom line The bottom line refers to the net earnings or profit a company generates from its business operations in a particular accounting period that appears at the end of the income statement. A company adopts strategies to reduce costs or raise income to improve its bottom line. read more of the entity's income statement. Investors should be cautious while analyzing line items arising from the non-core business transaction.

Limitations

- Reporting of net operating income and expenses can be counter-effective as well as companies with a higher level of net operating income are regarded as having poorer earnings quality Quality of earnings refers to the income generated from the business's core operations (recurring) and does not include the one-off revenues (nonrecurring) generated from other sources. Quality evaluation helps the financial statement users to make judgments about the "certainty" of current income and the future possibilities. read more .

- It does not have any significance in measuring the operating prowess of the entity and hence may only serve as a line item that needs to be analyzed in isolation as it is derived from non-core activities that do not form the mainstream income for the entity.

Points to Remember

- Non-operating income and expenses are likely to be one-time events such as loss due to asset impairment Impaired Assets are assets on the balance sheet whose carrying value on the books exceeds the market value (recoverable amount), and the loss is recognized on the company's income statement. Asset Impairment is commonly found in Balance Sheet items such as goodwill, long-term assets, inventory, and accounts receivable. read more

- Some non-operating items are recurring in nature but are still considered non-operating as they do not form the core business activities of the entity.

Conclusion

Both experience sudden ups and downs as operating performance tends to remain more or less the same for stable companies. It appears at the bottom of the income statement, after the operating profit line item.

Recommended Articles

This has been a guide to Non-Operating Income. Here we look at the list of Non-Operating Income and its calculation and formula, along with practical examples. You may learn more about financing from the following articles –

- Examples of Operating Expense (OPEX)

- What is Operating Income?

- Net Operating Income

- Income Statement Formulas

colemantherettill.blogspot.com

Source: https://www.wallstreetmojo.com/non-operating-income/

0 Response to "Non Operating Income in Continuing Operations Income"

Post a Comment